CIP Carriage and Insurance Paid To: The Protected Passage

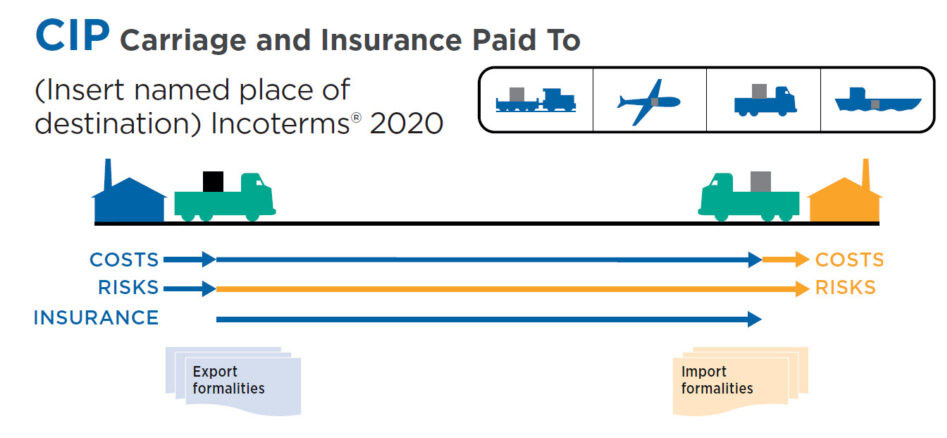

The term CIP Carriage and Insurance Paid To is similar to CPT, but with the added requirement that the seller purchases insurance for the goods. Picture yourself on that same train, but this time, you’re also insured for the journey. This is CIP. Since its birth in 1980, CIP has been the safer alternative for multi-modal transport, mirroring CIF’s protective approach.

Seller’s Obligations:

Deliver the goods to the carrier at the named place of shipment.

Pay for the cost of transport and insurance to the named place of destination.

Clear the goods for export.

Buyer’s Obligations:

Clear the goods for import, paying any customs duties.

Bear all risks of loss or damage once the goods have been delivered to the carrier.

CIP instance:

The seller: A Chinese producer of replacement lithium batteries for electrical tools

The buyer: A middle brand of electrical tool parts in Texas, USA,

Shipping incoterm: CIP (Carriage and Insurance Paid to) for two containers of lithium batteries

Under CIP, the seller delivers the goods to the carrier or another person nominated by the seller at an agreed place, contracts for and pays the costs of carriage necessary to bring the goods to the named place of destination, and also contracts for insurance cover against the buyer’s risk of loss of or damage to the goods during the carriage.

Here’s how the costs would break down:

- Product Cost: Agreed price for the batteries is $30,000.

- Local Logistics: Costs for delivering goods from the factory to the port in China (seller’s responsibility), let’s say $1,500.

- Export Customs Clearance: Costs for the goods to be cleared for export by Chinese customs (seller’s responsibility), let’s say $500.

- Freight Charges: Cost of shipping goods across the ocean to the destination port in Texas, USA (seller’s responsibility under CIP), let’s say $3,000.

- Insurance: Cost of insurance to cover the buyer’s risk of loss or damage to the goods during carriage (seller’s responsibility under CIP), let’s say $1,000.

So, the total cost to the seller (CIP price) is $30,000 + $1,500 + $500 + $3,000 + $1,000 = $36,000.

Shipping:

- Import Customs Clearance: Duties and taxes for goods to be cleared by US customs (buyer’s responsibility), let’s say $4,000.

- Local Logistics: Costs for delivering goods from the port to the buyer’s warehouse in Texas, USA (buyer’s responsibility), let’s say $1,500.

So, the total cost to the buyer is the CIP price ($36,000) plus the costs of Import Customs Clearance ($4,000) and Local Logistics ($1,500). That is, $36,000 + $4,000 + $1,500 = $41,500.

Under CIP, the seller has the obligation to arrange and pay for the carriage of the goods to the agreed destination, and also to procure insurance against the buyer’s risk. However, the risk transfers from the seller to the buyer as soon as the goods have been handed over to the first carrier.

CPT term is closed to CIP term.