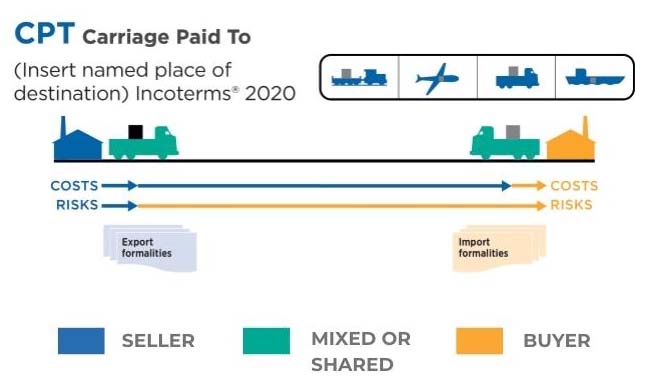

CPT Carriage Paid To: The Paid Passage

Under the term CPT Carriage Paid To, the seller pays for carriage to the named place of destination, but the risk transfers to the buyer once the goods have been handed over to the first carrier. Imagine you’re on a train, comfortably seated, knowing that your ticket has been paid for. That’s CPT. Introduced in 1980, CPT is a modern twist on CFR, reflecting the shift from sea to multi-modal transport.

Seller’s Obligations:

Deliver the goods to the carrier at the named place of shipment.

Pay for the cost of transport to the named place of destination.

Clear the goods for export.

Buyer’s Obligations:

Clear the goods for import, paying any customs duties.

Bear all risks of loss or damage once the goods have been delivered to the carrier.

CPT instance:

CPT: Carriage Paid To

Let’s use an example to explain the pricing and shipping under the Incoterm CPT (Carriage Paid To).

We can use this scenario: A Chinese seller is shipping electronic products to a buyer in the United States.

Here’s how the costs would break down:

- Product Cost: Agreed price for the electronics is $20,000.

- Local Logistics: Costs for delivering goods from warehouse to the port in China (seller’s responsibility), let’s say $1,000.

- Export Customs Clearance: Costs for the goods to be cleared for export by Chinese customs (seller’s responsibility), let’s say $500.

- Freight Charges: Cost of shipping goods across the ocean to the destination port in the US (seller’s responsibility under CPT), let’s say $2,000.

So, the total cost to the seller (CPT price) is $20,000 + $1,000 + $500 + $2,000 = $23,500.

Shipping:

- Import Customs Clearance: Duties and taxes for goods to be cleared by US customs (buyer’s responsibility), let’s say $3,000.

- Local Logistics: Costs for delivering goods from the port to the buyer’s warehouse in the US (buyer’s responsibility), let’s say $1,000.

So, the total cost to the buyer should be the CPT price ($23,500) plus the costs of Import Customs Clearance ($3,000), and Local Logistics ($1,000). That is, $23,500 + $3,000 + $1,000 = $27,500.

Under CPT, the seller has the obligation to arrange and pay for the carriage of the goods to the agreed destination, but the risk transfers from the seller to the buyer as soon as the goods have been handed over to the first carrier, which is different from the FOB term.

Which term is closed to CPT?

The Incoterm that is most similar to CPT is CIP (Carriage and Insurance Paid to). Both require the seller to arrange and pay for the transportation of the goods to a specified destination. The key difference is that under CIP, the seller also has to procure and pay for insurance against the buyer’s risk of loss of or damage to the goods during the carriage. Under both terms, the seller needs to arrange and pay for transportation, but only under CIP does the seller also have to arrange for insurance. The risk of loss or damage transfers from the seller to the buyer as soon as the goods have been handed over to the first carrier in both cases.