How much do you know about Amazon Warehousing And Distribution(AWD) In China? Do you know the news about boosting China Local “Forward Warehouses”! Amazon Launches Accelerated Logistics Plan to Enhance China Localization?

By optimizing cross-border logistics supply chain management, we aim to better assist Chinese enterprises in establishing flexible supply chains and digital transformation. Cross-border logistics is a crucial supply chain capability for sellers to expand into global markets and achieve long-term business growth. Beyond strengthening the localization of first-leg logistics, there is still much room for improvement

— said Peng Jiaqi, Vice President of Amazon China and Head of Product and Seller Education for Amazon Global Selling Asia-Pacific, in an interview with Southern Metropolis Daily in China.

On May 24, Amazon announced the launch of the “2024 Amazon Export Cross-border Logistics Accelerator Program” in China. This is the first comprehensive plan under the concept of “cross-border logistics” since Amazon announced its “end-to-end supply chain service” last September, including the establishment of Amazon Warehousing and Distribution (AWD) in China.

With over 20 years of experience in global logistics, Amazon’s accumulated resources and technological advantages in logistics are significant, providing Chinese sellers with various logistics solutions. The release of the “Cross-border Logistics Accelerator Program” is related to the upcoming Amazon Prime Day, but it also addresses changes in the cross-border sector due to the rise of local platforms.

For example, the concept of “managed services” has become more localized. Most cross-border e-commerce platforms, except Amazon, eBay, and Walmart, are involved in the “managed services” competition. Initiated by local cross-border e-commerce platforms in September 2022, companies like TEMU, SHEIN, TikTok, AliExpress, and Shopee now offer such services.

Products can be sent directly from factories to domestic warehouses, where inventory can be managed intelligently, automatically replenished, and distributed globally. Although Amazon does not consider its “end-to-end” solutions as fully “managed services,” it emphasizes one-stop service while maintaining sellers’ autonomy and brand strength.

This approach creates conditions for “factory direct sales” sellers to maximize their presence on Amazon. The concept of “managed services,” as an interpretation of cross-border e-commerce platforms’ localization capabilities, offers Amazon new insights. The improvement of Amazon’s local operational capabilities and the real feedback from enterprises going global will continue to be monitored by the Southern Metropolis Daily cross-border e-commerce research team.

Strengthening First-leg Logistics – Amazon Warehousing And Distribution In China

Amazon’s localization upgrade this year focuses on cross-border logistics.

Enhancing global supply chain solutions is a strategic priority for Amazon Global Selling China in 2024. By involving logistics, warehousing, and operations, Amazon opens up the entire process of cross-border e-commerce for sellers.

Cross-border logistics supply chains consist of three main parts: first-leg, cross-border, and last-leg logistics. The emphasis on first-leg logistics and the reiteration of “end-to-end” solutions highlight Amazon’s determination to enhance localized operations and extend logistics capabilities to Chinese industrial zones.

In the first quarter of 2024, China’s cross-border e-commerce total value reached 577.6 billion RMB, with a year-on-year growth of 9.6%. The number of standard containers exported from China increased by 10% year-on-year. As a new form of foreign trade, cross-border e-commerce continues to show impressive growth in 2024.

As an important path for Chinese manufacturing to go global, sellers’ understanding of cross-border e-commerce platforms is improving, but their core needs remain unchanged: the effectiveness of the platform, the usability of solutions and services, efficiency, and cost. Logistics is a crucial link in supply chain efficiency and profitability.

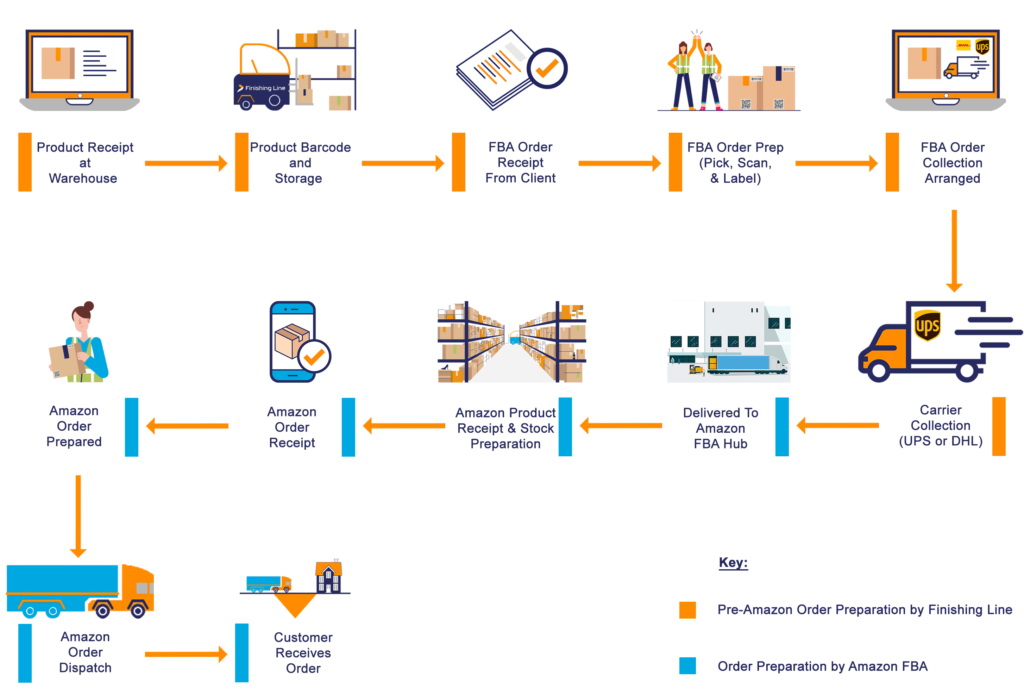

At the end of 2023, Amazon’s Supply Chain All-in-One (SCA) solution was made available to Chinese sellers. This solution includes Amazon Global Logistics, Amazon Warehousing and Distribution Network (AWD), Fulfillment by Amazon (FBA), and Amazon Multi-Channel Fulfillment (MCF), helping sellers deliver products directly from manufacturers to customers worldwide.

The “2024 Amazon Export Cross-border Logistics Accelerator Program” will further support sellers in cross-border logistics in four areas:

- Offering smarter and more diverse cross-border logistics services and products. For example, Amazon Global Logistics has added “Guangzhou-Foshan integrated pickup” to its existing pickup areas, providing more convenient first-leg pickup for cross-border shipments in these regions.

- Simplifying cross-border logistics supply chain management and improving cross-border logistics efficiency, with Amazon Global Logistics continuing to accelerate the customs clearance process at European destination ports.

- Implementing global innovations and local initiatives to help sellers save on logistics costs, with specific product solutions offering 15% to 25% fee discounts.

- Strengthening local team building to empower sellers at all stages of cross-border logistics.

Amazon Warehousing and Distribution Network is an innovation of Amazon Logistics. These forward warehouses offer a more favorable storage solution, allowing sellers to avoid placing all their goods in Amazon’s fulfillment centers and incurring high fees. Thus, slower-selling products and faster-selling products should be managed with different solutions to reduce the costs associated with each product throughout the supply chain

— said Peng Jiaqi

Oversized Items as a Pain Point in Cross-border Logistics

There is still room for continued improvement.

In terms of end-consumer experience, Amazon has always been fast in delivering to destination countries and continues to accelerate. This consumer experience has garnered Amazon a loyal following, naturally providing a foundation for sellers to expand into overseas markets.

In 2023, Amazon provided its fastest delivery service ever to global Prime members, with over 7 billion items delivered on the same day or the next day. In the first three months of 2024, Amazon broke its record for delivery speed to Prime members again, with over 2 billion items delivered on the same day or the next day. In March 2024, in over 60 major cities in the U.S., 60% of Prime member orders were delivered on the same day or the next day. In London, Tokyo, and Toronto, three-quarters of Prime member orders were delivered on the same day or the next day.

Whether on the seller side or the consumer side, as Peng Jiaqi put it, “There is still ample room for improvement in cross-border logistics.” How will improvements be made for large and oversized items, which are challenging in cross-border logistics?

According to Peng Jiaqi, although Amazon Global Logistics has solved many issues with large items today, specific products like furniture, which involve assembly and large space occupancy, require consideration of delivery disassembly and better user experiences, such as avoiding early occupation of public spaces at delivery points. Amazon Warehousing And Distribution In China.

Su Dengying, Head of Amazon Global Logistics China Sales, stated that Amazon Global Logistics has dedicated warehouses in Los Angeles, Oakland, and Seattle on the U.S. West Coast to handle large items. Through algorithms and overall seller inventory levels, these warehouses better distribute to different large-item warehouses in the U.S. This year, Amazon added eight non-standard item peak season replenishment warehouses on the U.S. West Coast to meet the needs of sellers for large items during peak seasons, such as outdoor products and furniture, helping sellers solve the problem of timely warehouse entry during peak seasons.

How to sell from China to the US?

GWT Notes

In recent years, the rapid rise of local cross-border e-commerce platforms like SHEIN, TEMU, TikTok, and AliExpress has provided more options for Chinese manufacturing to go global. Amazon remains a primary consideration for sellers looking to expand overseas or build international brands. However, multi-channel and multi-market layouts have become industry consensus.

Regardless of how the landscape of going global changes, the core needs of sellers remain the same: fast, efficient, stable, safe, cost-effective, and profitable. As industrial zones increasingly embrace going global, manufacturers, suppliers, and sellers close to the Chinese supply chain upstream are stepping into the spotlight. Lowering the threshold for going global and providing “grounded” services are key concerns for sellers going global.

On May 10 and May 15, Amazon Global Selling opened offices in Zhengzhou, Henan, and Wuhan, Hubei, attracting significant industry attention. Behind the collaboration with local governments, Amazon is eyeing the industrial clusters in Wuhan and Zhengzhou as important cities in central China.

For example, Hubei Province is building five trillion-yuan industrial clusters, ten 500-billion-yuan industrial clusters, and has 20 strategic emerging industries and advanced manufacturing clusters. Wuhan’s industrial zones include home furnishings, textiles and apparel, auto parts, medical equipment, and equipment manufacturing.

In Henan, there are 40 major categories of industrial products, such as wigs from Xuchang, lithium batteries from Xinxiang, and makeup brushes from Luyi.

Whether emphasizing “end-to-end” logistics supply chains or opening offices in industrial zones, Amazon is indeed trying to get closer to sellers in China, which is essentially a reflection of accelerated localization upgrades.

As cross-border business flourishes, you’ll find that as sellers’ businesses grow, you need a more comprehensive and scalable solution. We can’t do things the way we used to; we need to push for improvements in service quality and coverage

—Said Peng Jiaqi in an interview with Southern Metropolis Daily

In other words, in the cross-border e-commerce race, standing still means falling behind. It’s very important to know Amazon Warehousing And Distribution In China.