The English translation of the text you provided is as follows:

In 2022, conflict erupted between Russia and Ukraine. Experts pointed out that this is another major event profoundly affecting the world’s economic trends, following the Sino-US trade friction and the outbreak of the COVID-19 pandemic. By providing effective and coordinated humanitarian logistics services, supply chain management can play an important role in mitigating the negative impacts of war.

How to Deal with Supply Chain Disruptions

Since the outbreak of the Russia-Ukraine conflict, many companies have announced a halt to the purchase of Russian products. In addition, many companies in Ukraine are unable to maintain basic economic activities, causing major damage to global goods transport. Therefore, in addition to playing a key role in providing humanitarian aid through supply chain management, it is also necessary to deal with the challenges of supply chain disruptions. Ukraine is a major global producer of semiconductor raw material gases. According to a survey report by Techcet, Ukraine’s share of global neon gas supply reaches 70%, and this rare gas is very important for the photolithography process in semiconductor production. In addition, the lithium oxide reserves in the eastern region of Ukraine may be close to 500,000 tons. As is well known, the production of electric vehicle batteries requires metallic lithium, and lithium oxide ore is a major source of lithium. As the “granary of Europe”, Ukraine is also the world’s third-largest grain exporter and a major producer and exporter of corn, wheat, and barley. In addition, the Black Sea region where Ukraine is located produces 60% of the world’s sunflower oil, 75% of which is export-oriented. Russia has rich non-ferrous metal mineral resources and is the country with the largest reserves and supply of the rare metal palladium, with reserves accounting for about 46% of the global total and production accounting for about 35%. Palladium is used in the semiconductor industry and is an indispensable key material in the aerospace, aviation, and other high-tech fields as well as the automotive industry. Moreover, European countries generally have a high degree of dependence on Russia’s oil and natural gas. Russia is a global powerhouse of natural gas resources, accounting for one-fifth of the global natural gas trade market; Russia is also the second-largest oil exporter after Saudi Arabia, with a daily output of 5 million barrels.

Challenges Facing the Logistics Industry

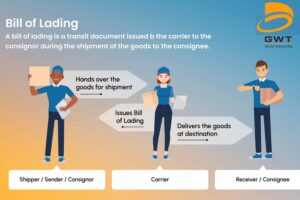

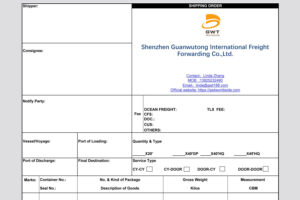

After the outbreak of the COVID-19 pandemic, the global logistics transportation system was severely impacted. The Russia-Ukraine conflict could add fuel to the fire, affecting transportation by sea, land, and air, especially at sea. The goods of foreign trade export companies may face situations where they cannot be shipped normally, have difficulty arriving at the port normally, or cannot be picked up normally. Severe congestion has occurred at major ports. It is estimated that as of mid-February 2022, as many as 70 container ships are still waiting to dock at US ports. In the Asian and Western markets, the imbalance in container supply continues to cause delays in picking up goods from the source. Affected by the Russia-Ukraine conflict, several shipping companies including Hapag-Lloyd AG, Maersk, and Ocean Network Express have temporarily suspended the booking of goods to and from Russia, and there are cases where some export companies cannot deliver samples and bills of lading to Russia. Various products destined for the Russian market have been affected, and container ships carrying these goods are docked at ports along the route, waiting for the next instructions. The increasingly strict inspections by the customs authorities of the relevant countries and the constantly changing credit terms further increase the transportation costs of goods and shorten the delivery cycle of goods. As the space for shipping companies to release goods to Russia or Ukraine is limited, it is expected that there will be a backlog of goods at multiple ports of origin. Currently, other solutions for storage facilities and equipment are being explored based on the storage status and shelf life of the goods. Russia’s sanctions by Western economies and exclusion from the SWIFT payment system can be seen as a knee-jerk reaction, further raising concerns about whether products can be produced smoothly and transported to conflict areas. In terms of intermodal transport of bulk goods to Eastern Europe or the Russian market, one mitigation measure is to unload at other ports in Europe first, and then use road or rail transport systems to transport the goods to their destination. In the coming weeks, the geopolitical landscape and its evolution will largely determine whether many products, other than pharmaceuticals, healthcare, and food industries, can circulate smoothly. Air transportation has always been a very important mode of transport for high-value products, especially for goods in industries such as electronics, semiconductors, and “fast fashion”. In the early stages of the Russia-Ukraine conflict, many routes from Europe to Asia had to be diverted because they could not enter Russian airspace, forcing a large number of cargo planes to fly around, greatly increasing flight times and fuel costs. Air freight companies may need to use more fuel on each trip and tend to offer smaller and lighter goods booking services to customers. Under the impact of high inflation, the development of the manufacturing industry faces a recession, which may significantly increase the price of air freight. Against this backdrop, freight booking should prioritize humanitarian aid and the transportation of “life-saving drugs” or health products to affected areas. In addition, due to the cancellation of flights to Russia by several airlines in the Western Hemisphere, the available capacity for high-value perishable products to North Asia has been significantly reduced. Finally, it needs to be emphasized that in the “last mile” delivery of bulk commodity cross-border trade, carriers always play a key role. In fact, due to a shortage of truck drivers, road transport was severely affected in 2021. According to industry insight analysis, about 30% of Ukrainian truck drivers are employed by Polish transport companies, and due to the impact of the Russia-Ukraine conflict, 80,000 people have returned to Ukraine, which has had a more profound impact on product transport from Western and Central Europe to the Far East. At the beginning of the sanctions, due to an assessment of the compliance of their own business with the sanctions, several large logistics companies suspended their business booking services. In Ukraine and nearby areas, nearly 12,000 truck drivers are still working, trying to safely return to the EU area. The early refugee flow of the Russia-Ukraine conflict also led to overcrowding at the Ukraine-EU border, and people often had to wait 2-4 days to pass smoothly. It is also worth noting that due to the limited loading operations at several ports in the Black Sea of Ukraine, longer routes are now needed to ensure that operators transport goods to Turkey, Georgia, and nearby countries. In addition, actively developing cargo insurance, road cargo carrier liability insurance, and other risk protection measures is a new challenge that the logistics industry currently needs to deal with, and these issues further increase costs. To this end, carriers need to ensure that goods are fully loaded and maximize the choice of return routes.

The Necessity of Supply Chain Transformation

To deal with the impact of the Russia-Ukraine conflict on the supply chain, the following measures can be taken:

(1) In the event of a production stoppage outsourced to Russia or Ukraine, the relevant factories need to find alternative products on the production line and urgently adjust the priority of production plans.

(2) Under the impact of the pandemic on production capacity, global paper packaging and flexible packaging suppliers are in the recovery phase of digesting backlogged orders. They need to work closely with upstream raw material and packaging component companies to quickly respond to changes in the situation.

(3) In the case of risks in picking up products, manufacturers of all industries producing products in Russia or Ukraine need to make decisions after weighing the costs.

(4) With the backlog of the supply chain, if it cannot afford the cost of losing part of the production capacity to replace products in conflict areas, the production plan for the next year may need to be maintained in advance.

(5) For products that are severely delayed in downstream transportation, or for key industries such as pharmaceuticals, healthcare, and life support devices that belong to humanitarian needs, the order of decision-making by manufacturers also depends on the risk of product obsolescence.

(6) From the perspective of supply chain planning, detailed planning guided by the company’s development goals and industrial planning is a very important link.

From the perspective of strategic procurement, improving the visibility of the entire value chain of products through first-tier, second-tier, and even third-tier suppliers will help highlight the high-risk entities that purchase from Russia or Ukraine, as well as conduct in-depth research on the procurement situation, check whether there are single-source suppliers, what buffer stocks are, whether there are effective business continuity plans that can be activated, and so on. A recent research report by supply chain risk management company Interos shows that the US and Europe have more than 1,100 and 1,300 first-tier suppliers in Russia, respectively, and more than 400 first-tier suppliers in Ukraine from the US or European countries. In addition, up to 5,000 companies in the US and Europe are facing third-tier supplier risk issues, so risk mitigation measures may be initiated in a short period of time. For supply shortage problems caused by raw material shortages or high inventory costs, a reasonable solution is to confirm and introduce emergency backup suppliers as early as possible. In the medium term, due to the obvious obstacles faced in the choice of raw material costs and logistics methods, cross-industry supply chains need to prioritize ensuring timely product supply for customers, which is still a daunting challenge. In addition to the impact of the COVID-19 pandemic, the Russia-Ukraine conflict may also have rekindled people’s thinking about this issue—how to achieve the best balance between localized and dedicated supply chains and economically efficient but riskier global supply chains. In recent years, affected by the superimposition of multiple factors such as anti-globalization, the rise of trade protectionism, and the COVID-19 pandemic, the safe and stable operation of global industrial chains and supply chains is being severely impacted, and the Russia-Ukraine conflict may evolve into the biggest test of their resilience.