Tudo o que você precisa saber sobre o desembaraço aduaneiro para importação da China

Entender os meandros do desembaraço alfandegário para importar da China é crucial para um processo de remessa tranquilo e eficiente.

Visão geral do desembaraço alfandegário para importação da China

Evolução do sistema alfandegário

O desembaraço aduaneiro para importação da China evoluiu significativamente nas últimas décadas. Anteriormente conhecido por sua complexidade, o sistema foi simplificado para facilitar o comércio global. A introdução de plataformas digitais e processos automatizados simplificou os aplicativos, reduzindo os tempos de liberação e aumentando a transparência.

Importância da conformidade

A conformidade com as normas alfandegárias é essencial para evitar atrasos e penalidades. O entendimento das regras que regem as importações garante que as remessas sejam processadas sem problemas. A não conformidade pode resultar em multas, confisco de mercadorias ou problemas legais, o que torna crucial manter-se informado sobre as políticas atuais.

Principais políticas e regulamentos

Taxas e impostos de importação

O desembaraço alfandegário para importação da China envolve a compreensão dos impostos e taxas de importação. Esses encargos variam de acordo com o tipo de mercadoria e seu valor declarado. É importante classificar com precisão as mercadorias de acordo com os códigos do Sistema Harmonizado (HS) para determinar as taxas aplicáveis. Além disso, o Imposto sobre Valor Agregado (IVA) e o Imposto de Consumo podem ser aplicados dependendo da categoria do produto.

Itens proibidos e restritos

Certos itens são proibidos ou restritos para importação na China. Os itens proibidos incluem produtos falsificados, materiais perigosos e determinados produtos alimentícios. Os itens restritos podem exigir permissões ou licenças especiais, como produtos farmacêuticos ou eletrônicos. Familiarizar-se com essas regulamentações é vital para evitar problemas durante o desembaraço aduaneiro.

Documentação necessária

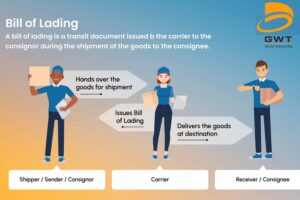

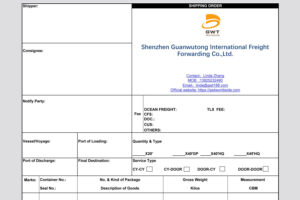

Documentos essenciais

O desembaraço alfandegário bem-sucedido para importação da China requer vários documentos importantes. Eles incluem o conhecimento de embarque, a fatura comercial, a lista de embalagem e o certificado de origem. Cada documento deve ser preciso e completo para evitar atrasos. Garantir que todas as informações correspondam aos documentos é fundamental para um processamento tranquilo.

Arquivamento eletrônico e simplificações

A China implementou sistemas de arquivamento eletrônico para simplificar o desembaraço alfandegário. Plataformas como a Janela Única de Comércio Internacional da China permitem que os importadores enviem documentos on-line, reduzindo a burocracia e o tempo de processamento. Familiarizar-se com esses sistemas pode aumentar a eficiência e simplificar o processo de importação.

O processo de desembaraço alfandegário

Preparação para a liberação prévia

A preparação é fundamental para um desembaraço alfandegário eficiente na importação da China. Isso envolve verificar se toda a documentação está completa e precisa e garantir a conformidade com as normas de importação. A contratação de um despachante aduaneiro pode ajudar na preparação e no envio da documentação necessária, minimizando erros e atrasos.

Inspeção e liberação alfandegária

Depois que os documentos são enviados, as remessas podem estar sujeitas a inspeção. Os funcionários da alfândega podem verificar o conteúdo da remessa para garantir que ele corresponda à documentação. Se forem encontradas discrepâncias, a remessa poderá ser atrasada. Depois de liberadas, as mercadorias são liberadas para entrega. A compreensão desse processo ajuda a prever possíveis problemas e a planejar adequadamente.

Trabalho com um despachante aduaneiro na China

Benefícios da assistência profissional

A parceria com um despachante aduaneiro oferece inúmeras vantagens. Esses profissionais têm conhecimento profundo das regulamentações alfandegárias e podem lidar com as complexidades do processo. Eles ajudam a garantir a conformidade, reduzem o risco de atrasos e lidam com quaisquer problemas que surjam durante o desembaraço.

Escolhendo o parceiro certo

A seleção do despachante aduaneiro certo é fundamental. Procure um parceiro com experiência em seu setor e um histórico sólido de desembaraços bem-sucedidos. A comunicação eficaz e a transparência são fatores-chave na construção de uma parceria bem-sucedida, garantindo um processo de importação tranquilo.

Desafios e soluções comuns

Como lidar com atrasos e disputas

Podem ocorrer atrasos e disputas durante o desembaraço aduaneiro para importação da China. Os problemas comuns incluem documentação incorreta, classificação incorreta de mercadorias ou mudanças regulatórias. Ter um plano de contingência e manter uma comunicação aberta com seu despachante pode ajudar a resolver esses desafios com eficiência.

Manter-se atualizado com as mudanças nas políticas

As políticas alfandegárias na China estão sujeitas a alterações. Manter-se informado sobre atualizações e novas regulamentações é essencial para a conformidade. Assinar boletins informativos do setor, participar de seminários comerciais e trabalhar em estreita colaboração com seu despachante aduaneiro pode ajudá-lo a ficar à frente das mudanças e adaptar seus processos de acordo com elas.

Conclusão

Navegar no desembaraço alfandegário para importar da China requer um entendimento completo das políticas, da documentação e dos procedimentos. Mantendo-se informadas e fazendo parcerias com profissionais experientes, as empresas podem garantir um processo de importação tranquilo e eficiente, aprimorando suas operações de comércio global e minimizando os possíveis riscos.